After a difficult 2023, the Contech Investment Climate Survey from Zacua Ventures explores investor sentiment and key emerging trends for 2024

As the construction industry braces itself for another year of unprecedented challenges and opportunities in the face of high interest rates and material costs, skilled labour shortages and geopolitical uncertainties, the insights gleaned from the first quarter of the year and the expectations gathered in a survey conducted by Zacua Ventures to over 100 investors offer some clarity for navigating the complex terrain ahead.

It was a difficult 2023 for Contech investment, marked by widespread decline in VC activity, a substantial decrease in start-up valuations and an overall challenging fundraising landscape for start-ups (thereby creating a favourable scenario for funds with available capital).

To gauge the pulse of the market in 2024, Zacua Ventures conducted its Annual Contech Investment Climate Survey, now in the second year, with input from 114 VC and CVC firms to understand their investment sentiment and foresee trends for the 2024 Contech fundraising environment.

Resilience amid adversity: The construction industry’s response

Following a challenging 2023, with a widespread decline in tech investment, construction tech has proven resilient and investors face 2024 with a cautious optimisim, driven primarily by a convergence of technological innovation on AI and sustainability imperatives. According to CEMEX Ventures, investments in construction technology in Q1 was 20% higher than the same period in 2023, with majority of the deals being done in the fields of productivity and sustainability tech.

These initial results are aligned with the expectations gathered in the survey, in which 88% of venture capital investors as well as corporate investors express their intentions to either maintain or increase their capital deployment in 2024, signalling a bullish outlook towards Contech investments. This positive sentiment underscores the industry’s resilience in the face of macroeconomic uncertainties and underscores its appetite (and need) for innovation and growth.

Technological innovations shaping the future

The Contech investment landscape in 2024 is defined by a variety of transformative technologies poised to reshape the construction industry. Chief among these is artificial intelligence (AI), which promises to revolutionise project management, optimise resource allocation and enhance safety protocols. AI has increased its potential to impact the construction industry thanks to the possibility of processing unstructured data, which is now lowering the barriers for tech adoption and allowing traditional contractors to take value of their data, no matter how well structured is it.

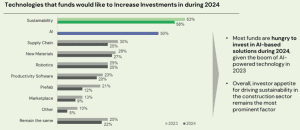

The survey reveals that more than half of respondents are looking to increase their investments in areas of AI and sustainability, which goes up to 80% if we only take into account corporate investors. This underscores the industry’s recognition of the transformative potential of these technologies, the increased need to adopt technology to face continuous challenges and reflects a strategic shift towards data-driven decision-making and sustainable practices (or a need to comply with increased regulatory pressures).

As sustainability emerges as a central tenet of Contech investments, driven by a confluence of regulatory mandates, corporate sustainability goals and societal imperatives, we can group these technologies into two main areas: tackling embodied carbon and operational carbon.

From green building materials, optimal design parameters, reduced waste on sites and increased reusability and recycling of building materials to portfolio carbon analysis, renewable energy solutions, smart building management systems and new methods for renovating existing assets, the quest for environmental stewardship gets into every facet of the construction ecosystem, driving investments in eco-friendly technologies and sustainable practices.

The road ahead: Implications and expectations

As a consequence of facing increased pressure from different fronts, the construction industry is embracing technology more than ever before, supported by a wider ecosystem of solutions and an entrepreneurial and investor landscape that is willing to become the outsourced R&D arm of the industry, which still ranks second to last in innovation investment.

Regional differences will persist, with the US continuing to represent 50%+ of Contech investments and Europe 20 to 30%. However, it is expected that the growth rate in new investments will be higher in developing economies, particularly Asia (India & SE Asia), Middle East and LatAm, in which the industry shows higher growth rates, and the companies are starting (or accelerating) their tech adoption path.

Finally, as more corporates launch their Corporate Venture Capital division to become more active in a growing start-up ecosystem, we can expect some tailwinds in the technology market, particularly in an increased backing in deep techs (robotics, new materials, hardware components) at the early stages, providing strategic support in product development in early TRL start-ups, where traditional VCs may be more hesitant to deploy significant capital.